JobKeeper Payment

Dear valued clients and friends of Yield.

We hope that you and your family are well, and you are coping during these uncertain times.

The Government and the ATO have just updated the process for applying for the JobKeeper payment. This email is to update you about what you need to do to claim this payment and how we can assist you to claim the amount to which you are entitled.

JobKeeper Payment Overview

JobKeeper is a Federal Government subsidy paid to eligible businesses effected by COVID-19 to help cover the costs of their employee’s wages.

Affected employers will be able to claim a fortnightly subsidy payment of $1,500 per eligible employee from 30 March 2020, for a maximum period of 13 fortnights. This full amount of $1,500 must then be paid to all eligible employees, whether they are full time, part time or casuals.

Here is a brief summary of how the JobKeeper payments are made:

- They are paid by the ATO within 14 days of month end.

- The first payment will be paid soon after 4 May 2020.

- The eligible payroll periods are every 14 days, commencing 30 March 2020.

- Monthly employer payroll reporting is required to trigger the payment by the ATO – using Single Touch Payroll (STP)

The employer will continue to receive the subsidy payments for eligible employees while they are eligible for the payments. While the program is expected to run for 6 months, payments will stop if the employee is no longer employed by the business.

Business Participation Entitlement

Sole traders and some other entities (such as partnerships, trusts or companies) may be entitled to the JobKeeper Payment scheme under the business participation entitlement. A limit applies of one $1,500 JobKeeper payment per fortnight for one eligible business participant. Sole traders, one partner in a partnership, one beneficiary of a trust, and one director or shareholder of a company may be regarded as an eligible business participant.

See further information here.

Value of Jobkeeper to you

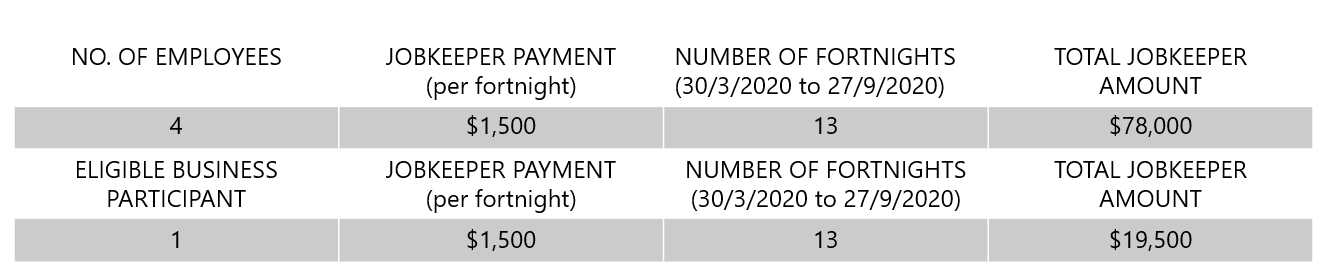

An example; If you are eligible to receive the JobKeeper payment for 4 eligible employees for the entire 6 month period and you have a Business Participation Entitlement as the business owner, it is estimated that you would receive the total JobKeeper payment amount as calculated below:

This is obviously a huge assistance to you during these difficult times.

Obligations and risks for you

If a wrong claim is made, or if the ATO in the future decides that you were ineligible to receive the JobKeeper payment, the ATO will require you to repay any JobKeeper payments that you have received plus penalties and interest.

The key risks to you as the employer include:

- The employer certifies the facts provided to the ATO and the JobKeeper claim made.

- The employer receives significant JobKeeper payments over a 6 month period. For example, an employer with 4 employees would receive $78,000 and an employer with 10 employees would receive $195,000.

- If the employer makes a mistake and is found to be ineligible by the ATO (for example, its turnover is not down by 30%), then they may have to repay all amounts received back to the ATO.

- An employee ceases to be eligible if they cease employment during the life of this JobKeeper scheme.

Also, please note the ATO requires you to keep all records in relation to your JobKeeper claim for a 5 year period.

How we can assist you

The ATO has specific actions that must take place within tight time frames for an employer to receive the JobKeeper payment.

These are the actions that we can assist you with:

Eligibility Assessment

- Review ATO requirements for employers (see ATO guidelines here)

- Review ATO requirements for employees (see ATO guidelines here)

- Review ATO requirements for Business Participation Entitlement for Sole Trader, Partnerships, Companies and Trust (see ATO guidelines here)

- Document the fall in turnover % in case of future ATO audit (see ATO guidelines here)

Identify Eligible Employees

- Review list of eligible employees.

- Review JobKeeper employee nomination notice for all eligible employees and ensure all notices are signed (see standard employee nomination forms here)

- Yield would require all employee notices on file prior to enrollment in Jobkeeper system

Make Correct Wage Payments to Eligible Employees

- Ensure your payroll software is correctly set up to record JobKeeper “top up” payments (see Xero processing instructions here)

- Pay the minimum $1,500 before tax to each eligible employee each fortnight (starting with the fortnight ending 12 April 2020) to be able to claim the JobKeeper payment for that fortnight

- Continue to pay the minimum $1,500 to employees in every subsequent fortnight until 27 September 2020, when the program ends.

Enrolment for JobKeeper – From 20 April 2020

- Enrol for JobKeeper using ATO online services from 20 April 2020. Note it is our current understanding that to be eligible for the April Payments the enrolment must be made by 30 April 2020. (see ATO instructions here

- Provide employer bank account details for receipt of JobKeeper payment

- Confirm if applicant is entitled to a “Business Participation Payment”

- Specify the number of employees who will be eligible in the first and second fortnightly periods.

- Get confirmation that all employees the employer plans to nominate are eligible and the employer has notified them and has their agreement.

Apply for JobKeeper Payments – From 4 May 2020

- Apply to claim the JobKeeper payment using ATO online services between 4 May 2020 and 31 May 2020 (ATO Instructions not yet available)

- Ensure all eligible employees have been paid $1,500 per fortnight prior to 30 April 2020.

- Identify the eligible employees from a STP prefill or by manually entering into ATO online services

- Update your accounting system Chart of Accounts to ensure JobKeeper payments are coded correctly

Monthly JobKeeper Declaration Report – Due by 7th Day of Each Month

- Using ATO online services, report to the ATO using their Monthly JobKeeper Declaration Report on the following: (ATO instructions not yet available)

- Reconfirm that your reported eligible employees have not changed

- Input current GST Turnover for the reporting month

- Input projected GST Turnover for the following month

- Notify if any eligible employees have changed or left your employment

Our Engagement

During the process of the Government releasing it’s Covid 19 stimulus we at Yield have done our utmost to keep you informed about eligibility and the necessary processes by way of phone calls, emails and Facebook posts. Up until now the payments for Jobseeker and the Cash Boost have been available via existing Government networks such as Centrelink and the ATO Business Activity Statement system.

We have also provided information on Jobkeeper as it has come to hand and the information available has been changing rapidly to the point that the Enrolment form for the payment was released on 20th April and it appears the due date for lodgement to be eligible for the April reimbursements is the 30th April. This has put an enormous amount of pressure on Yield’s resources and no doubt every other accounting practice across the nation.

With that in mind we have not asked for this process and don’t particularly wish to profit from it, hence we have provided as much information as possible so clients who wish to, can take care of these processes themselves. We are however offering to complete the work for those wanting to engage with us for our assistance.

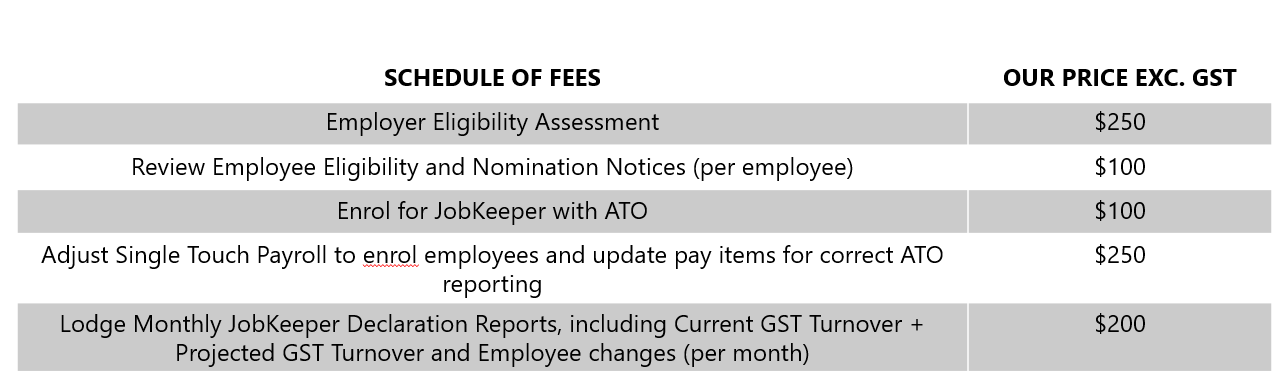

Clearly if you do engage Yield there is a lot of work required to be done so that you can potentially receive the JobKeeper benefit and be compliant with your lodgement and record keeping requirements. We want to be as transparent as possible with you about how we have calculated our price for our services and advice in relation to Jobkeeper payment.

In this regard please note the following schedule of fees for the various tasks that may or may not be required depending on the individual circumstances of each client.

Once we determine your individual requirements we will be able to provide you a monthly fee, spread over the 6 months of the Job Keeper payments, to assist with your cashflow requirements..

Next Steps

You have limited time to enroll for JobKeeper (starting on 20 April 2020) and then making your first Application for JobKeeper Payments (starting on 4 May 2020).

We wish to reiterate that we believe we have provided you with all the resources required for you to self-assess your eligibility, register for the program, setup Xero and apply for payments in the event you wish to undertake this assignment on your own, however we believe this will be an onerous and complex task with an element of risk in the event mistakes are made, hence we have made the above offer to assist.

If you feel you require our assistance to undertake all the tasks mentioned above, please complete the following documents with an much information as possible and return them to us as a matter of urgency. We will assist in completing any missing information:

Please note we will require these forms to be completed and signed prior to lodging your Enrolment for the JobKeeper payment.

We look forward to hearing from you soon.

Kind regards