Spring Newsletter

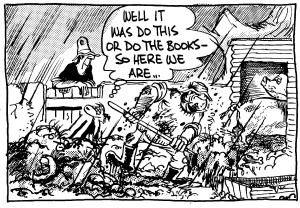

Welcome to Yield’s spring edition newsletter. It has been an eventful few months at Yield and the pace continues to grow with new and existing clients taking up and converting to Xero. The expertise built in the past two years by all of the staff is really shining through with great results and immense satisfaction from clients involved in the transition and now utilising the program. As a result we have less clients with Wal’s attitude in the cartoon below (thanks and RIP Murray Ball). Our aim at transitioning to an advice based firm for the benefit of our clients is really taking shape.

In this edition we introduce Brendon Burvill in the first of our series of professional partners with whom Yield works closely in collaboration for your benefit. We have a focus on superannuation, with the way we are now providing advice and an overview of the recent rule changes. The business Southern Belle Boutique is profiled and we discuss the all important Personal Property Security Register (PPSR). We hope you find the e-newsletter informative and thought provoking. Please remember to like our Facebook page and visit our website.

Brendon Burvill – Burvill Financial

At Yield we are focusing on building partnerships with professional people to whom we can confidently refer our clients. Having a network of professionals who we can trust to assist with our clients needs outside our accounting scope allows us to confidently provide a rounded service. The types of professions being teamed up with are legal, banking, financial planning and others.

In this edition we introduce the financial planning business Burvill Financial which is run by Brendon, Megan and Reilly Burvill from Bridgetown.

Brendon has been providing financial advice in the South West for over 10 years. He’s always available to help either in person or remotely.

Brendon believes “Financial planning is about providing the right advice at the right time. Whether it’s ‘preparing for the worst’ or ‘preparing for the best’, when the time is right for you, I’ll be happy to help.”

The services provided by Burvill Financial include; personal insurance reviews, recommendations and placements; retirement planning, including investments, super, pensions and Centrelink advice.

Yield Group is pleased to announce that we and Burvill Financial will be working together for you.

T 08 9761 2126 | M 0401 003 912 | burvillfinancial.com

The Emporium Building | Shop 7, 145 Hampton Street, Bridgetown 6255

Client Profile

Michelle Di Salvo – Southern Belle Boutique

Michelle Di Salvo with the support of her family has embarked on a life changing experience by entering into the world of retail, having recently purchased Southern Belle Boutique on Giblett Street.

Michelle took over the fashion outlet in May and has wasted no time in putting her stamp on the business. New flooring, a wood fire, new signage and and overall freshened appearance are just a few of the changes. Michelle intends on continuing to roll out the changes with an online sales presence just around the corner. Michelle is very keen for her business and products to be accessable to customers outside the Manjimup area and believes an online presence will help facilitate a wider client base.

The business is using the Xero accounting software and Michelle is very happy with the experience. “Jess has given us great support at Yield and we were impressed with the fact that Steve came to our house with our Bank Manager Matt from Westpac to discuss our financial arrangements. We never thought that would happen. It just made the whole experience personalised and pain free. Good old fashioned service!”

Michelle’s focus is to make women enjoy the shopping experience at Southern Belle, feel special and look great throughout the spring/summer season and leading into Christmas and is well stocked with the latest fashion lines. Yield encourages it’s clients and friends to drop into Southern Belle Boutique for a fresh and friendly shopping experience at 83 Giblett Street Manjimup, call on 97711176 or visit the Facebook page.

Superannuation Rule Changes

The 2017 federal budget saw the announcement of some of the most significant changes to the superannuation rules in recent years. As a result of the changes and the opportunities and challenges they represent Yield is running a four part series on our Facebook page and our website blog. We encourage you to follow our informative and not so conventional views on this topic. ![]()

We have summarised the major changes to the super rules (applicable from 2017/2018 year) below;

- Annual concessional (before-tax) contributions cap reduced to $25,000 for all eligible Australians

- Removal of the 10% rule which will now allow employees to contribute tax deductible lump sums – a critical planning opportunity

- Annual non-concessional (after-tax) contributions cap reduced to $100,000

- A $1.6 million total superannuation balance cap restricting non-concessional contributions, co-contributions and spouse contributions

- Increase in income threshold for spouse superannuation contributions tax offset to $37,000 (and $40,000)

- Low Income Superannuation Tax Offset replaces LISC

- Removal of tax exemption for transition-to-retirement pensions (TRIPs)

- 30% tax on concessional (before-tax) super contributions under the Division 293 rules from $300k to $250k

- Preservation age now at least 57 years

- Age Pension increases to at least 65.5 years

- Introduction of First Home Super Saver Scheme

- Removal of option to treat a pension payment as a lump sum payment, for tax purposes

- Removal of anti-detriment provisions

For more detail in relation to the changes and how they may effect you go to ATO Super Changes or call one of our great staff at Yield. Please also read our introduction to the SMSF Advisers Network (SAN) below and the way we now provide our superannuation advice.

Self Managed Super Fund Advisors Network (SAN)

In recent times there have been legislative changes that have changed the way that accountants are able to give advice about superannuation and in particular Self Managed Super Funds.

The government introduced the Future of Financial Advice (FOFA) reforms which became mandatory for the financial planning industry on 1 July 2013 . The objectives of FOFA were to improve the trust and confidence of Australian investors in the financial services sector and ensure the availability, accessibility and affordability of high quality financial advice.

As part of FOFA accountants were given an exemption to provide limited financial product advice as they had always done up until the 1 July 2016. The exemption was repealed from that date. This means that all accountants must now be covered by an Australian Financial Services (AFS) licence to give advice about acquiring or disposing of an interest in an SMSF – that is, they must either hold an AFS licence or be a representative of an AFS licensee.

Yield has chosen the path of becoming an authorised representative of the National Tax Agents Association wholely owned licensed body; SMSF Advisors Network (SAN). Derek and Steve are licenced representatives of SAN and Lee is about to follow the process of becoming registered. This is a quite arduous process which requires the completion of the equivalent of a financial services diploma. We believe having completed this process and becoming qualified authorised representatives of SAN give Yield another professional point of difference.

As a result of operating through SAN you will notice changes to the way we give you advice on super. Whilst the process is time consuming and slightly annoying as accountants have been giving advice on super for many years, we feel that it does give us confidence that our advice has been looked over and approved by a third party. When providing advice that is given under the SAN licence we must provide a Financial Services Guide, request clients to complete a fact finder and once the advice is complete provide a Statement of Advice which must be reviewed and approved by SAN. This process must be adhered to prior to doing any of the work associated with the underlying advice, say the establishement of a new SMSF .

We look forward to continuing to give SMSF advice as it is a growth area with enormous benefits for the right clients.

Personal Property Security Register (PPSR)

The PPSR is a national register where an ownership interest over certain assets is registered in order to protect that interest in the case of events happening such as death or bankruptcy. Not having your assets registered can result in loss of those assets. Real life examples shows how the legislation is applied can seem quite illogical and unfair, with significant losses to the unwary.

Yield strongly advises its clients to speak with us or qualified legal professionals specialising in PPSR to protect your valuable assets.

The PPSR commenced in January 2012 and applies to items such as but not limited to plant and equipment, machinery, goods supplied i.e. stock and hire/lease of equipment to a third party.

If you are purchasing a piece of equipment you can also search the item on the register to ensure that there is no other party holding a security interest over the item. This could save a headache if the seller does not have full rights to sell – for instance if there is finance still held over the item, the financier may have rights to collect.

An example of where the legislation seems unfair and registering your equiment on the PPSR would be critical is where it is hired out or is even present on another entities property. If that is the case and the third party goes bankrupt there is a very good chance your equipment would form part of the bankruptcy estate and be very difficult to reclaim.

The general rule of thumb is that if it is yours and someone else has it then register it!!!

- To register visit PPSR.GOV

- Check contracts, terms and conditions and the relevant PPSR clauses are included

- The following info is required to register an interest over another entity

- the other entities details (ABN, ACN, Date of birth if appropriate)

- Copies of the signed agreements

- Description of items being sold, hired, stored

- Create a security interest using PPSR.GOV and follow the instruction

- Seek professional help to ensure it is correct

- Review your standard trade terms and conditions and have them reviewed by a professional

Registration is a cheap form of insurance with the most common types of transaction being registering a finance statement for 7 years being $6.80 and a search by grantor, serial number or registration number costing $3.40. No excuses based on those figures.

Note that advice on the PPSR is legal in nature and outside the scope of what Yield’s professional indemnity. We can however recommend specialist legal practitioners who can assist.

Staff news

Some staff changes have happened at Yield which sees some new faces and a return of a familiar one.

For those of you that have had a long association with Yield (and previously Hampton Partners) you will remember our long serving employee Cathie Hordienko. Cathie left us 7 years ago to gain experience in other industries and has recently come back to assist with the individual income tax return season. Welcome back Cathie!

Emma Lintott joined our team last year to assist with client bookkeeping and has more recently commenced working in the office on Mondays. This has allowed Emma to forge relationships with clients and staff. Emma is a qualified accountant and brings with her a number of years of tax and accounting experience. She has been a welcome addition to our team.

When coming into our office from Wednesday to Friday you will be greeted by Zoe Wilson. Zoe has been with us since August and is currently assisting in reception and administration while completing her accounting degree. After the completion of her up and coming exams, Zoe would have completed her first year of university. Well done Zoe!

Lee-Anne is back from her trip around Australia with her family and has described the experience as nothing short of amazing! They made it to every state & territory and clocked up over 18,000kms in just under 3 months! Here are a few snaps at some of their highlights.

Disclaimer

The Material contained in our newsletter is no more than general comment for the benefit of clients and associates of Yield Accounting Group. Readers should not act on the basis of the material contained in our newsletter without taking professional advice relating to their particular circumstances.

Liability limited by a scheme approved under Professional Standards Legislation