Summer 2021 Newsletter

Hello Clients and Friends of Yield

We welcome you to our summer 2021 edition of our newsletter where we will update you on some of the exciting things happening at Yield, provide some technical information on pertinent up to date developments and preview one of our lovely clients who give their experience of working with Yield.

You may have noticed it’s been a while since our last newsletter however in the meantime we have put a massive effort into guiding our clients through the Government stimulus arrangements as a result of COVID and provided information and updates throughout. We feel our district and client base has been hugely resilient and in fact prospered overall through this time. With the ultimate opening of the borders, it seems clear that there are still challenges ahead as a result of the Pandemic but we stand ready to assist our clients come what may.

As Christmas approaches once again, we reflect on what it means to be in business. It is such a rewarding experience yet so challenging as well. We have our fantastic staff at Yield who are our backbone, and we pay tribute to them. We are blessed at Yield to have such a united and cohesive team who have an ethos of professionalism and helping each other to give the best client experiences.

We wish you the very best for the festive season. It is noticeable and a common sentiment that we are all so busy. We hope that the holiday season gives everyone a chance to enjoy some down time, enjoyed with family and friends and to reflect on 2021 and set some new goals for 2022.

Check Your myGov Inbox

The ATO are changing the way they communicate and are committed to using electronic channels wherever possible. Communication methods include SMS, email and via the myGov inbox.

These changes have been particularly problematic in recent times, as clients have not been aware of ATO communications sent to their myGov inbox, which has at times resulted in a failure to meet tax payment obligations on time.

To ensure these problems do not continue please note that if you have set up a myGov account and have linked the ATO to that account, you have agreed to receive certain ATO correspondence into your myGov Inbox. This means that your correspondence won’t come to you via mail or to us, your tax agent.

The types of ATO correspondence you may receive in your myGov Inbox include:

- Notices, such as your Notice of Assessment

- Statements of account

- Confirmation and reminder notices

- Activity statements and instalment notices

As we will no longer receive this correspondence on your behalf, it is essential you monitor your myGov Inbox regularly. The ATO state they will notify you by SMS or email if anything has been delivered to your inbox, however we urge you to access your inbox frequently to ensure you do not miss important correspondence or payment deadlines.

Please note, once you have linked the ATO to your myGov account it is not possible to change your mail delivery preference back to us. ATO correspondence will go automatically to your inbox unless you unlink the accounts.

If you do not have a myGov account or you have a myGov account but it is not linked to the ATO, your mail preference and delivery method will remain unchanged. You will continue to receive ATO correspondence as usual.

Please be in touch if you wish to check and/or change how your are currently receiving communications from the ATO.

Client Profile

Jeff & Robyn Daubney (Stockyard Cafe)

In 2016 after many years working in the hospitality industry with WA health, small private café’s and finally the mining industry an opportunity come from nowhere to purchase the small café in the Manjimup light industrial area now well known as The Stockyards Café.

After working for an employer for many years the opportunity to work for myself in an industry which I was well experienced with looked extremely attractive. I totally enjoy a chat, banter and to meet my regulars and new customers daily. Over the past 5 and a half years we have grown and developed a great supportive clientele and we totally appreciate all our customers support over this time and in particular over the last 18 months with the unpredictability of the new world with COVID.

Although totally rewarding, running your own business has its challenges. One area that we find most challenging in the café / fast food industry is the ever increasing price of stock and then the working out a fair price mark up to be financially sound for both us and our customers. We pride our business on providing excellent old country style home made food at a fair price so our customers receive value for money.

So for those of you out there that haven’t experienced us as yet please come on up to The Stockyards Café where we can guarantee you will receive a choice of some good old fashioned country style home made food.

At present with the uncertainty of COVID we plan to stay small as is, but once the world settles down we certainly will be looking at growing and expanding the business if the right opportunity arises.

To conclude we would like to thank all our valued customers and in particular our accountants at YIELD for all their business and private advice and support over the past 5 and a half years. Without YEILD managing our accountancy needs we would have no free time after the busy week.

Thank you all.

Staff Changes

Georgina Galsworthy

Georgina, originally from England, joined Yield in August 2020. Holding a university law degree, Georgina has also studied aspects of business and accounting and hopes to progress in the accounting industry.

Outside of work, Georgina enjoys the outdoors, long walks and spending time with family and friends

Kaitlin Cybula

Kaitlin joined Yield in January 2021 as an accountant in the Pemberton office, after graduating with a Bachelor of Commerce from Curtin University in 2020. Kaitlin grew up in the region and sees Yield as an opportunity to develop her career and knowledge in the community.

Kaitlin enjoys spending time with her family and friends, regularly catching up for coffee. In her spare time, she plays netball and explores beaches along the south coast

Jess Liebregts

Jess started her maternity leave in October 2020 and has spent a wonderful year with little Zara. She has enjoyed her time away so much she has decided to not return to the world of accounting for now and focus on her family and other endeavours.

Jess started with Yield, 8 years ago and it has been wonderful to see her grow in her roles as an Accountant over the years.

We wish Jess and her family all the best and we do hope to see her back one day.

Chelsea Brown

Chelsea started with us in August 2020 and she added something special to our reception area in the Manjimup office.

Chelsea was frequently complimented on her positive attitude and client service and she will certainly be difficult to replace as she explores all the opportunities of the city.

We will miss her smiley face and can’t wait to hear about all her new adventures.

More Baby News

Chloe & Blair

Chloe & her partner Andrew welcomed Blair Harriet at the start of the year, and since then they have been thoroughly enjoying their new addition.

Chloe returned to the office part time in August, and will continue on a part time basis in the New year so she can enjoy more time with Andrew and Blair..

Nicola & Grace

Nicola and her husband Gareth welcomed their daughter Grace Carol to the world in July 2020 and have been loving every moment they spend with her.

Nicola returned to the office on a part time basis back in August and will increase her days at the office early next year.

Directors Identification Number (Director ID)

A director identification number (director ID) is a unique identifier that a director applies for once and keeps forever. You’ll need a director ID if you’re a director of:

- a company

- a registered foreign company

- a registered Australian body, or

- an Aboriginal and Torres Strait Islander corporation.

You can apply for your director ID at the Australian Business Registry Services (ABRS).The date you must apply depends on the date you became a director.

- Directors appointed on or before 31 October 2021 have until 30 November 2022 to apply.

- Directors appointed between 1 November 2021 and 4 April 2022 must apply within 28 days of appointment.

- Directors appointed from 5 April 2022 must apply before their appointment.

Director IDs will improve data integrity and confidence in knowing who the directors of a company are.

You need to apply for your director ID yourself to verify your identity. No one can apply for you. The fastest way to get a director ID is to apply online using the myGovID app. It’s free and you only need to apply once.

Instructions on how to download and setup the myGovID app can be found HERE

For further information including a short explanation video can be found HERE

If you need assistance obtaining your director ID, please do not hesitate to contact us.

Stapled Super Funds for Employers

From 1 November 2021, if you have new employees start and they don’t choose a super fund, you may have an extra step to take to comply with choice of fund rules. You may need to request their ‘stapled super fund’ details from the ATO.

A stapled super fund is an existing super account linked, or ‘stapled’, to an individual employee so it follows them as they change jobs. This aims to reduce account fees, avoiding new super accounts being opened every time an employee starts a new job.

You will need to request stapled super fund details for new employees who start on or after 1 November 2021, when:

- you need to make super guarantee payments for that employee

- they are eligible to choose a super fund, but don’t. This includes contractors who you pay mainly for their labour and who are employees for super guarantee purposes.

You may need to request stapled super fund details for some employees who aren’t eligible to choose their own super fund. This includes employees that are:

- temporary residents

- covered by an enterprise agreement or workplace determination made before 1 January 2021.

For employees that started working for you on or after 1 November 2021 and have not provided you with their choice of super fund, you should make contributions into:

- the employee’s stapled super fund ,or

- your employer nominated account (if the ATO advises you that they do not have a stapled super fund).

However, once an employee tells you their choice of super fund, you have 2 months to start paying contributions into that fund.

Full details of the new rules including a video presentation that guides you through the steps you need to take to request your employees stapled super funds can be found HERE on the ATO website.

A copy of the ATO reference guide for employers can be found HERE

Please be in touch if you need assistance introducing the new rules to your business.

Key Superannuation Changes from 1 July 2021

1. The employer contribution rate increased to 10%

The Superannuation Guarantee (SG) employer contribution rate increased to 10% on 1 July 2021.

The Superannuation Guarantee rate is the minimum percentage of an individual’s salary (ordinary time earnings) that their employer must pay into their superannuation. The SG rate has been 9.5% since 2014.

2. Contribution caps have increased

The annual limit on how much you can pay into super increased on 1 July 2021.

Caps for both concessional (before-tax) and non-concessional (after-tax) contributions have been increased for the 2021/22 financial year – as shown in the table below.

| Cap type | 2020/21 | 2021/22 |

|---|---|---|

| Concessional cap (before tax contributions) | $25,000 | $27,500 |

| Non-concessional cap (after tax contributions) | $100,000 | $110,000 |

These cap increases could benefit individuals who are accessing bring-forward arrangements (non-concessional contributions) or carry-forward rules (concessional contributions).

3. The age restriction for bring-forward arrangements has increased

On 1 July 2021, the age restriction for bring-forward arrangements (see above) was increased from 65 to 67 years.

This means that individuals aged 65 and 66, who were not previously able to access the bring forward non-concessional contributions cap, may now do so. This change applies to non-concessional contributions made on or after 1 July 2020.

4. Changes to the transfer balance cap

The transfer balance cap is the maximum amount of super that an individual can transfer into retirement phase income streams during their lifetime.

The general transfer balance cap has been $1.6 million since 2017, and on 1 July 2021 it was indexed to $1.7 million.

5.The excess contributions charge has been removed

From 1 July 2021, individuals who exceed their contributions cap will no longer be charged an excess contributions charge. They will still be issued with a determination and taxed at their marginal tax rate on any excess concessional contributions amount (with a 15% tax offset to account for the contributions tax already paid by their super fund).

Staff Day

As the end of financial year rolled over for yet another year we took the opportunity to close the doors, swap the usual office attire for a choice flano and to head out into our beautiful neck of the woods exploring the sites and tasting the local wares.

The day commenced in Manjimup with a scrumptious champagne breakfast at Sooma compliments of Deb Sillaots and her team, it was hard not to overindulge however we knew there was more food to come not far down the road.

With Graeme Dearle at the wheel of his trusty Pemberton Discovery Tours bus we piled aboard and headed out to Dave and Monica’s Pemberley Wines for a very extensive wine tasting accompanied by fresh marron, freshly baked bread and hot buttered potatoes from the field.

All aboard again and off to the Southern Forests Chocolate Factory for a presentation on the chocolate making process before devouring some sweet samples and loading up on some favourite chockies for further down the track.

Our final destination was at a campsite on Snottygobble Loop next to Carey Brook. Awaiting our arrival was the rest of the Dearle gang including Toni who had arranged the campsite and put together some tasty finger food and Cam and Kieran who had come out earlier to setup a smoky camp fire.

After more food (including toasted marsh mellows) and drinks it was time for the highlight of the day “The annual Yield awards” which are not your normal awards for great work, customer service etc… but an opportunity for unscrupulous individuals to secretly nominate colleagues for a humorous award. If you slipped up during the year that resulted in a funny moment, misstatement or mishap there’s a good chance your up for an award ! Unfortunately management are not protected from award nominations and in fact may well be targeted in the proceedings.

I think its fair to say the awards need to be keep inhouse so the winners are not overly embarrassed for their momentary slip ups ! No doubt everyone is watching their backs and looking for opportunities to pay back colleagues at the next round of the awards.

After the awards it was time to board the bus and head back into town hopefully reinvigorated for the year ahead.

Thanks to Graham and Toni for helping organise what was another great day out for all the crew at Yield.

Hubdoc

Hubdoc is an app that comes free with every Xero Standard or Premium Plan, it allows you to quickly and easily upload bills and receipts using your mobile device, desktop, email or scanner, giving you access to the documents you need, when you need them.

Once the documents are uploaded to HubDoc the key data is automatically extracted and synced to Xero with source documents attached. From there the transactions are ready for the one-click bank reconciliation.

If you would like assistance setting up and using Hubdoc please don’t hesitate to contact us.

CLICK HERE for more information on Hubdoc & Xero

Environmental Matters

Electric Vehicle News

The rise of the electric vehicle is already big news in Europe as governments bring in legislation that will phase-out diesel/petrol vehicles. Examples include:

- France – sale of new diesel/petrol vehicles banned from 2040

- Germany – sale of new diesel/petrol vehicles banned from 2030

- United Kingdom – sales of new diesel/petrol vehicles banned from 2030

While Western Australia is not proposing similar legislation at this time, some small steps are taking place to plan for a future where electric vehicles will be commonplace.

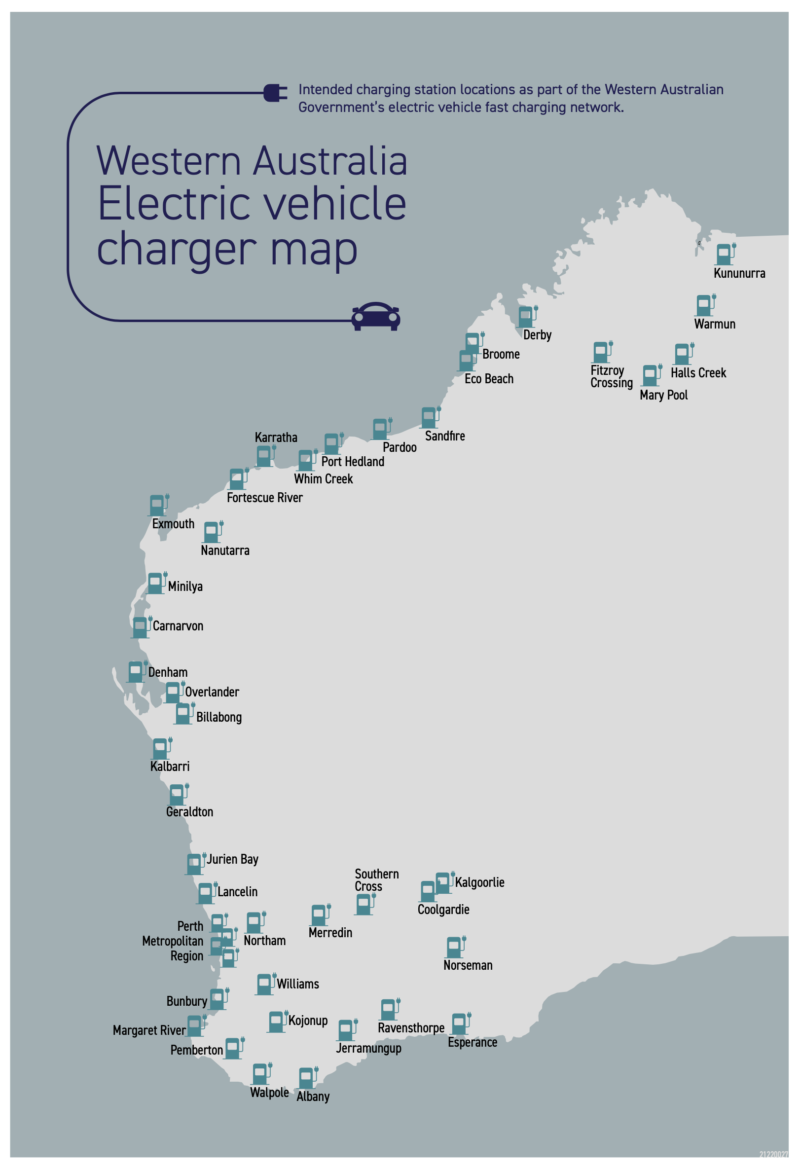

The WA government recently announced that the nation’s longest electric highway will be developed in Western Australia, with 45 spots to make up the electric vehicle fast charging network. It will include up to 90 fast charging stations and back-up chargers in locations stretching as far north as Kununurra, south to Esperance and east to Kalgoorlie. The average distance between charging stations will be about 160km.

According to the WA government, most electric cars can run for at least 400km, and it is expected the technology will improve further in the next few years. Under the plan, electric vehicles could be charged within 15 minutes, with spots chosen to encourage tourists to spend time in regional towns. A tender for the design will go out by the end of the year, with the network expected to be fully operational by early 2024.

That may seem a long way off, but it is never too early to consider what changes, impacts and opportunities the forthcoming switch to electric vehicles might have on your business..

Christmas & New Year Closure

Yield will be closed over the festive season from 5.00pm Thursday 16th of December 2021, reopening for business at 8.30am Tuesday 4th January 2022.

From all of us here at Yield, have a wonderful Christmas and New Year, we look forward to working together with you in 2022.

Disclaimer

The Material contained in our newsletter is no more than general comment for the benefit of clients and associates of Yield Accounting Group. Readers should not act on the basis of the material contained in our newsletter without taking professional advice relating to their particular circumstances.

Liability limited by a scheme approved under Professional Standards Legislation.