JobKeeper V2 – Employee Eligibility Update

Dear valued clients and friends of Yield.

We hope that you and your family are well.

Further amendments to the JobKeeper program were released last Friday 14th August 2020 that allow more employees to qualify for the Jobkeeper payment. This is achieved by extending the eligible employee test to also include eligible employees who were employed on 1 July 2020 (in addition to those employed on the original 1 March 2020 employment date), where they are not currently nominated for JobKeeper payments with another entity.

As a result, more employees may qualify for JobKeeper payments from 3 August 2020 (i.e., JobKeeper fortnight 10), if they were employed on 1 July 2020 and meet the other eligibility criteria. This includes employees who:

- were hired after 1 March 2020 (and are still employed on 1 July 2020);

- satisfied the 12-month employment requirement under the definition of a ‘long-term casual employee’ for JobKeeper purposes by 1 July 2020 (where they had not previously satisfied this requirement by 1 March 2020); or

- did not qualify on 1 March 2020 due to their age or visa status but have since met the relevant requirements by 1 July 2020 (e.g., employees who have since turned 18 or obtained the necessary visas).

Another very positive change relates to the ability for an employee to re-nominate with a new employer (which was previously not allowed). Broadly, if an individual was a 1 March 2020 employee of another entity but is not employed by that entity at any time from the start of 1 July 2020, then the individual is now permitted to give a nomination notice to a new employer. The same applies for eligible business participants, as applicable.

Importantly, as part of these recent modifications to the JobKeeper scheme, participating employers must take action immediately to ensure that any newly eligible employees (as a result of these recent changes) are provided with an employee nomination notice by Monday 24 August 2020. This is to ensure compliance with the ‘one in, all in’ principle, which broadly requires all eligible employees to be offered the opportunity to receive JobKeeper payments via their eligible employer who has opted to participate in the JobKeeper scheme.

Ultimately, the onus is on employers to ensure that all of their employees who are now eligible for JobKeeper payments as a result of the new 1 July 2020 test date are given the opportunity to be included. However, interestingly, despite the fixed date to provide the employee nomination form, the ATO is currently advising that if an employer does not do this within the required time, they will need to do so as soon as possible.

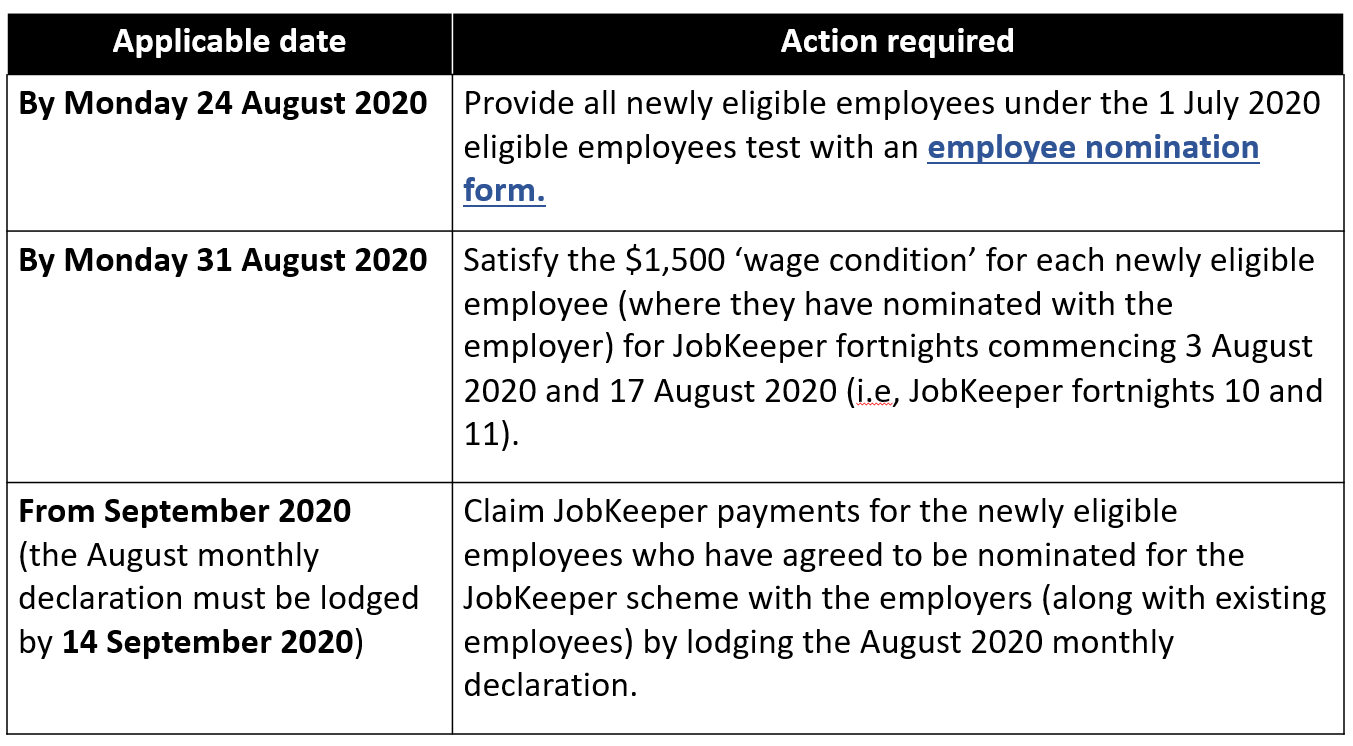

The following checklist provides a summary of the key dates (and actions) that participating JobKeeper employers must consider in relation to their newly eligible employees as a result of the new 1 July 2020 eligible employee test.

Next Steps

If you have engaged Yield to administer the Jobkeeper program (ie determine employer & employee eligibility, STP review, enrolment, completing monthly declarations etc…) for your business, we will be reviewing your payroll records to ascertain if any previously ineligible employee may now be eligible for Jobkeeper and if so, will be in touch as soon as possible to arrange the following:

- review and approve our employee eligibility sheet.

- complete employee nomination notices.

- ensure employees are paid the minimum requirement before 31 August 2020.

If you are administering the Jobkeeper program yourself you will need to act quickly to determine any changes to employee eligibility, competition of nomination forms and make payments by the 31 August 2020 deadline.

Either way remember we are here to help, so please be in touch if you have any queries or require our assistance to ensure you receive your full entitlements under the Jobkeeper program.